Saving more for a down payment can open up more affordable options for home buyers, especially if interest rates stay above 7%.

Down payments have always been important when it comes to home buying. In the current market — where interest rates are high and unpredictable, and home values are mostly stable or rising — how much you save for a down payment can be a deciding factor in whether you can afford the monthly payment.

According to a new Zillow® analysis of 50 major U.S. metros, more than twice as many markets become affordable if buyers living there put down 20% instead of 10%. Generally, a home is considered affordable if it doesn’t take up more than a third of your monthly household budget.

If you live in one of those metros — or you’re considering moving to a location where homes might be more attainable for you, it could be worth doing the math to see what you can afford based on your down payment goal and other factors.

How down payments affect affordability in various metros

Raising money for a down payment is often the hardest part of buying a home. It’s the reason a majority of successful buyers report tapping at least two sources for their down payment, including saving over time (75% did this) and receiving loans/gifts from family and friends (43% did). Other buyers cash out investments or take advantage of down payment assistance programs in their area. Some even add “home funds” to their wedding registries.

Putting more down toward a home purchase shrinks the amount you need to borrow from a lender, which lowers your monthly payment by reducing the amount of interest you have to pay on your mortgage. And buyers who put down more toward their purchase tend to get lower interest rates, which can save you even more money. That’s especially important at a time when interest rates and home prices are higher than they’ve been in the recent past.

Affordability is, of course, a relative measure that depends on your household income and where you live. Saving 20% for a down payment in pricey coastal markets could take decades and require an extremely high income. But in lower-priced markets, higher down payments can open up more affordable options for middle class buyers, especially those looking for starter homes and fixer-uppers.

Those shopping for starter homes could benefit in these markets

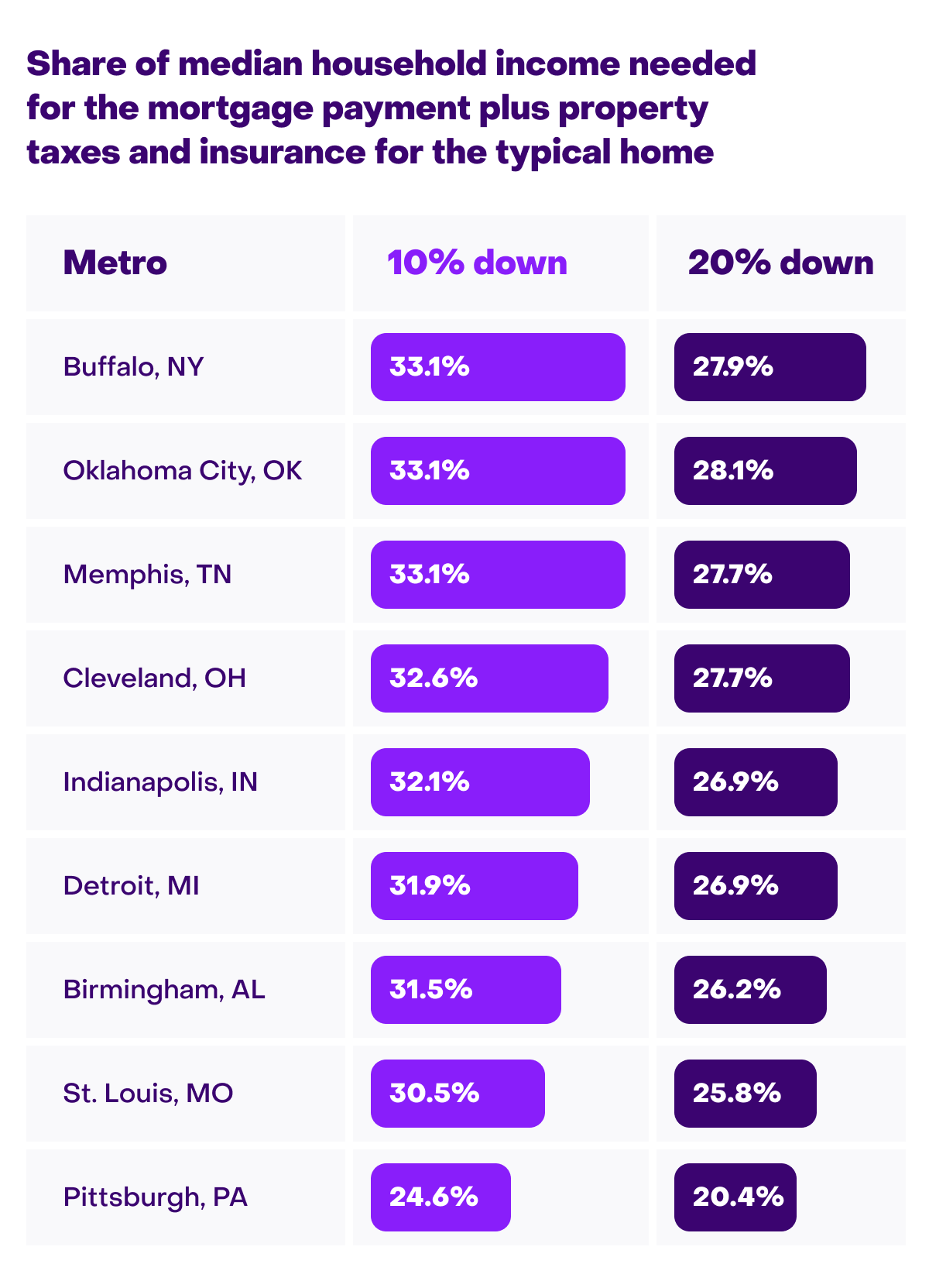

With a 10% down payment, which usually requires you to pay for private mortgage insurance, only nine metros would be affordable to the typical buyer who lives in the 50 metros we analyzed. Those metros are Pittsburgh, St. Louis, Birmingham, Indianapolis, Detroit, Memphis, Cleveland, Buffalo, and Oklahoma City. (Note: When we reference “typical buyers,” we’re referring to the median household income for people in that particular metro. Median means that half of the households in that metro earn more and half earn less.)

With a 20% down payment, the number of markets that become affordable jumps to 21. And if you can manage a 40% down payment, a big stretch for most buyers, the number of affordable markets nearly doubles to 41.

Those shopping for “starter” homes and fixer uppers in lower-priced markets could also benefit from putting more down, the data shows. Starter homes – those with values in the bottom third of the market — range from $113,497 in Pittsburgh to $376,100 in Washington, D.C.

Boosting down payments from 10% to 20% for homes in the lowest price tier increases the number of affordable markets from 34 to 40.

What makes a housing market affordable?

To come up with the list of affordable markets, Zillow’s Chief Economist Skylar Olsen looked at the average mortgage rate for prime borrowers in April 2024, the value of a typical home in each metro area as of April 2024, the median household income in that metro, and the income needed to comfortably afford that house (i.e., no more than a third of your household income would be spent on the mortgage). To calculate affordability, she looked at the monthly mortgage payment to buy that house, including locally estimated property taxes and insurance. For buyers putting 10% down, she also added the cost of private mortgage insurance (PMI) which is typically charged to buyers who put down less than 20%.

Here’s how it penciled out for a typical buyer in Houston:

- Typical home value: $310,900

- Typical household income: $81,600

- Monthly property taxes and insurance: $475

- Monthly mortgage payment (includes PMI at 10%):

- With 10% down: $2,052 ($2,527 with property taxes and insurance; 37% of typical household income)

- With 20% down: $1,654 ($2,129 with property taxes and insurance.; 31% of typical household income

For a typical buyer in Cincinnati:

- Typical home value: $283,700

- Typical household income: $80,000

- Monthly property taxes and insurance: $468

- Monthly mortgage payment (includes PMI at 10%):

- With 10% down: $1,872 ($2,340 with property taxes and insurance; 35% of typical household income).

- With 20% down: $1,509 ($1,977 with property taxes and insurance; 30% of typical household income)

For a starter home in Minneapolis:

- Typical value of a starter home: $274,800

- Typical household income: $99,000

- Monthly property taxes and insurance: $610

- Monthly mortgage payment (includes PMI at 10%):

- With 10% down: $1,851 ($2,224 with property taxes and insurance; 27% of typical household income)

- With 20% down: $1,462 ($1,835 with property taxes and insurance; 22% of typical household income)

For a starter home in Hartford:

- Typical value of a starter home: $255,700

- Typical household income: $93,200

- Monthly property taxes and insurance: $460

- Monthly mortgage payment (includes PMI at 10%):

- With 10% down: $1,722 ($2,182 with property taxes and insurance; 28% of typical household income)

- With 20% down: $1,360 ($1,820 with property taxes and insurance; 23% of typical household income)

How to determine how much you can afford

Annual income Help$

Calculate by paymentMonthly debts$Down payment$AdvancedCalculator disclaimerHome pricePaymentYou can afford a house up to$268,314Based on your income, a house at this price

should fit comfortably within your budget.$1,837/moFull report

To get an idea what your monthly payment might look like under different scenarios, you can start with this Affordability Calculator.

Mortgage loan officers can give you a more precise, personalized estimate of what you can afford. And an experienced agent can help walk you through the numbers and identify homes, along with local and state down payment assistance programs you might qualify for.

In the end, you may find that it’s cheaper to rent versus buy right now, and that’s okay. Markets change, and so do interest rates, so keeping an eye on what’s happening in your market and researching your options can help you make decisions on moving when the time is right for you. If your heart is set on buying, it can be good to know there’s a path to get there.