The process of buying a home using a VA loan is a little different than using other types of home loans. Here’s how to get started.

If you or someone you know are one of the approximately 19 million veterans eligible to buy a home using a VA loan, you’re in luck. This type of mortgage offers many advantages and is designed to help eligible active duty members, veterans, and their families find a more affordable path to homeownership.

Think you could qualify but you’re not sure where to begin? The good news is there are a plethora of resources and tools available for veterans on Zillow and beyond. To help ease the stress of trying to locate all the helpful resources, we’ve got them covered under the basic stages of getting funding below.

1. Researching whether you qualify for a loan

Understanding exactly what you need to qualify for a mortgage — in this case, a VA loan — is important when figuring out your options.

Zillow’s VA loan resource center offers several resources to help you, including:

Once you’ve determined whether you’re eligible, you can then focus on gathering the exact types of documentation you need to meet the eligibility requirements. (We cover that in the resource center, too.)

2. Figuring out what you can afford

Before looking at homes, it’s important to determine your housing budget. You want to be able to afford monthly mortgage payments comfortably and even anticipate what they may be, so you’re prepared.

Tools like Zillow’s VA mortgage calculator can help you estimate your monthly mortgage payment, including taxes and insurance. Don’t forget other homeownership costs like maintenance and repairs — it’s important to estimate a budget for those too.

3. The home search

Determining a budget and making a list of your must-haves and wants in a home is usually the easy part. The harder part is looking for homes that fit your criteria and, if you’re looking for a condo specifically, are eligible for VA loans. It can be cumbersome to look at home listings and switch between the VA website to determine whether that property was eligible for VA financing.

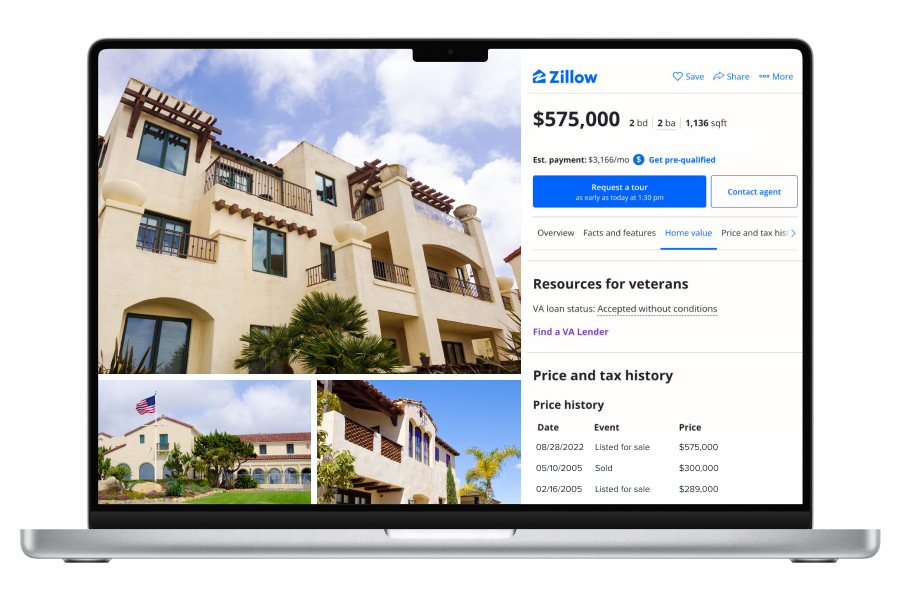

Check out Zillow’s condo search tool to simplify your home search process. Here, you can easily see at a glance whether the property you’re interested in accepts VA loans without having to navigate multiple websites.

4. Finding a mortgage lender

It’s a smart idea to find a mortgage lender who specializes in helping would-be home buyers purchase a property using VA loans. While you can generally ask for lender recommendations from friends and family, they may not have bought a home using a VA loan.

Aside from recommendations, you can consider looking online. Many sites have reviews you can read to see whether you think a lender would be a good fit. Zillow has a tool where you can quickly search for VA lenders near you.

It’s a good idea to speak to a few lenders to find one that offers the best fit for rates, repayment terms and your preferred form of communication.

5. General homeownership education and housing counselor resources

Figuring out your financing can be overwhelming. Whether you’re trying to juggle your mortgage payments with existing debt or learning how to build (or maintain) your credit score, it can help to have a little extra support. The U.S. Department of Housing and Urban Development (HUD) features a database of housing counselors across the country who offer financial and homebuyer education. You can also check out our resource centers for more tips, including: